OPERATION CHEMIST

Last week, the Hungarian National Tax and Customs Administration seized almost €2.3 million after unravelling a sophisticated VAT fraud scheme involving fake invoicing. A total of 7 individuals were arrested for their involvement in this tax evasion scheme.

As part of these actions, European Investigation Orders were carried out simultaneously in Poland, Slovakia and the United Kingdom. The ringleader was arrested in the United States in a speedy procedure on the request of the Hungarian authorities.

The clampdown targeted a Hungarian-led organised crime group responsible for defrauding the European Union of approximately €3 million. In total, police searched 193 premises, and seized more than €2.3 million in cash and goods, including real estate and luxury vehicles.

The syndicate used a sophisticated infrastructure to facilitate such tax evasion spread over various countries. Fake companies were set up that provided fictitious invoices to other enterprises, without in reality delivering the goods and services. The enterprises which received the bills then deducted these from their VAT payments in Hungary, leading to a net fiscal loss. To conceal the gains from the tax authorities, this gang is alleged to have set up different companies managed by foreign nationals.

A coordination centre was set up at Eurojust to support the action days, and Europol deployed to Hungary experts equipped with Universal Forensic Extraction Devices (UFED) to support the investigation on-the-spot.

OPERATION APPLE

Earlier this month, 6 people were arrested in a separate fraud investigation led by the Hungarian National Tax and Customs Administration of Hungary for their involvement in a tax evasion scheme which defrauded EU citizens of over €12 million in tax revenues via companies selling mobile phones.

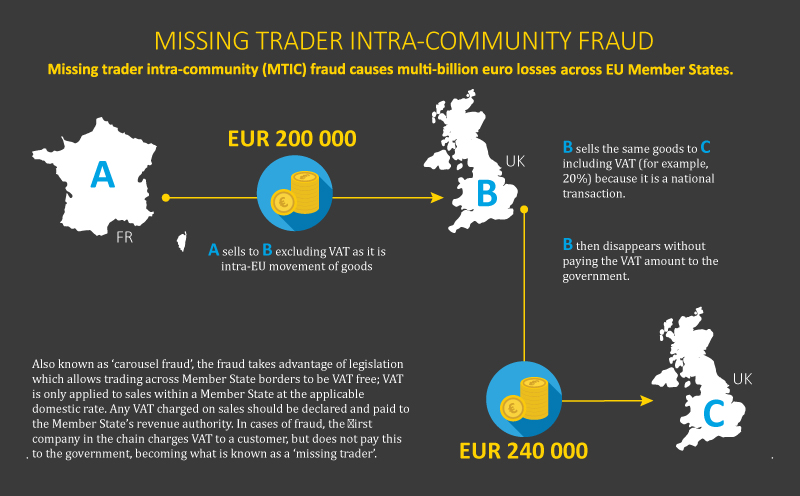

The ring imported mobile phones VAT-free from Austria, sold these phones in Hungary including a VAT charge and then went missing without paying the VAT owed to the Hungarian authorities.

In total, police searched over 37 premises, and froze over €6 million worth in assets. Europol also deployed its experts on-the-spot, equipped with mobiles offices and Universal Forensic Extraction Devices to facilitate the smooth exchange of information.

VAT FRAUD

VAT fraud might seem like a ‘white collar’ crime affecting only governments, but its consequences are far from victimless. The billions of euros that organised crime gangs have defrauded from taxpayers through this scam can find their way into dangerous hands, and are ultimately robbing citizens of the means for governments to fund vital public services.

This is why VAT fraud was identified as a priority for the European Union for the period 2018-2021 in its fight against organised crime.

Read more about this crime.

Tags

- Operational coordination

- Information exchange

- Press Release/News

- Press Release

- Other